Impact of Payment Rules on Sites of Care

- By Bonnie Kirschenbaum, MS, FASHP, FCSHP

THE U.S. HAS the most expensive healthcare in the world, well recognized for its unsustainable surging costs. Consequently, something must be done to curb this out-of-control growth. In answer, drug-pricing bills and proposals have flooded almost every government healthcare agency. Even the private payer sector is examining its insurance benefits and creating new payment models that lower prices for drugs and/or premiums. If these programs are implemented, patients will be able to obtain medicines at prices they can afford. However, for this to work, the healthcare sector must align the interests of all involved, including the patients, especially now when the focus is on high-investment medications and multiple complex drivers of change. To prepare for what’s coming, providers must look ahead, collaborate across disciplines and stay informed to adapt and innovate in the clinical, operational and business spheres of care delivery.

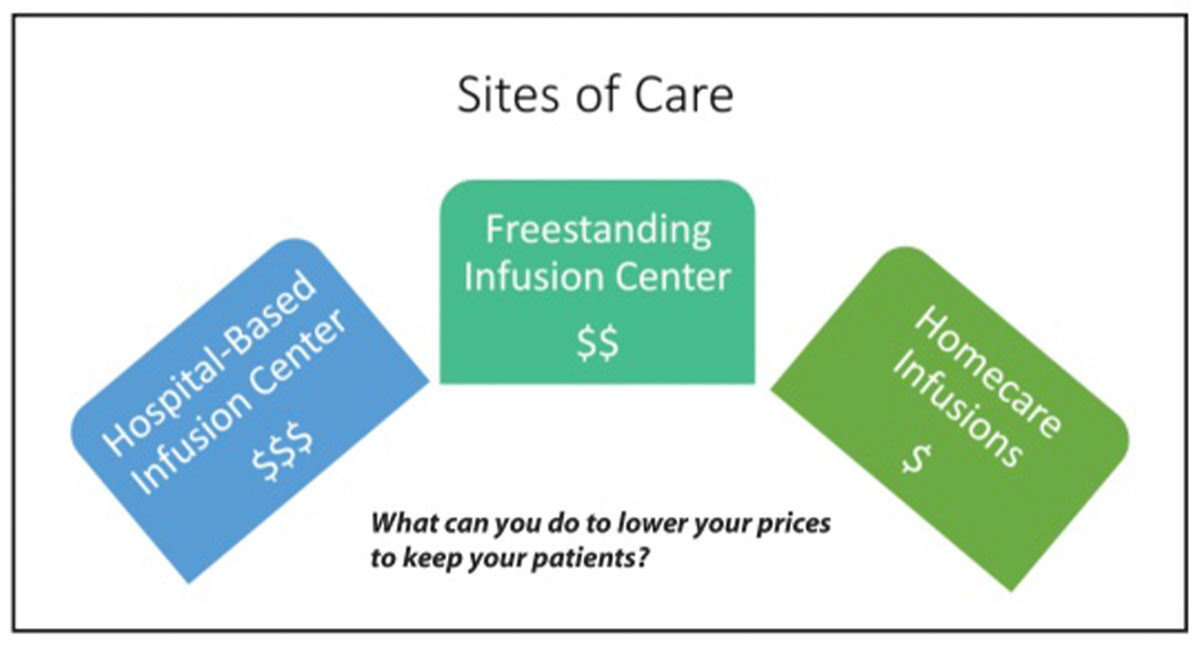

Where the patient receives care, known as the site of service, represents an interesting opportunity for significant savings. Sites of service include hospital inpatient care, hospital outpatient care, nonhospital clinic care and homecare. Hospital inpatient care is the most expensive option, and for many years, it has remained an option only for the sickest patients or the most complicated surgeries or procedures with an emphasis on the shortest possible stays. However, one of the nation’s biggest specialty care costs are provider-administered infused or injectable medical benefit drugs, and most often, these are administered in hospital inpatient centers. Therefore, to reduce costs, it is necessary to direct patients to the most cost-effective location to receive these medications while maintaining optimal clinical care. There are some concerns raised, though, about continuity of patient care, patients’ access to certain medications and the ability to respond to emergent adverse drug events in nonhospital-based settings.

The 2019 outpatient prospective payment system final rule set launched a site-of-care normalization program for hospitals that are losing significant revenue from Medicare patient clinic visits. This program, phased in over three years, reduces to 70 percent the cost for Medicare and patients, eventually reducing costs to 40 percent in year three. The proposed goal is to promote patients’ choice in site of service. If patients choose to remain with a hospital-based clinic, the cost both to Medicare and to patients (for their copay) is reduced. Since patients pay a 20 percent copay, staying with the hospital-based clinic prior to the launch of this program was a more expensive option than moving to a different site of care. But, with rate normalization, patient copays will be the same regardless of site-of-service choice. However, since Medicare currently does not negotiate Part B drug prices and sets its rates at average sale price plus 6 percent, patient copays for Part B drugs they receive during these clinic visits remain the same, and for many of the newer biologic, chemotherapy and immunotherapy drugs, these copays remain staggeringly high.

In 2018, there were 49 specialty drug approvals. Of these, 19 fell under Medicare Part D (the pharmacy benefit), 25 fell under Medicare Part B (the medical benefit) and five spanned the two benefit categories for various reasons. New Medicare Part B drugs included nine oncology/oncology support drugs, seven rare disease drugs, six autoimmune biosimilars, four in various other categories and two immune globulins (IGs). The private sector manages these with prior authorization, post-service claims edits, site-of-service shifts, dose optimization and implementation of biosimilar strategies.

Private health insurance plans providing Medicare benefits to 20 million (one third of all) beneficiaries will be able to negotiate Part B and Part D drug prices, as well as implement step therapy that can be applied only to new prescriptions for patients who are not actively receiving a given medication. Medicare Advantage plans are required to pass savings on to beneficiaries through rewards given as part of drug management care coordination that must be equivalent to more than half the amount saved on average per participant and can be in the form of lower premiums. Additionally, copays for Part B drugs received during clinic visits will fall accordingly.

To reduce unsustainable drug costs, private sector payers are providing insurance benefits to those purchasing plans through their employers, on their own or as Medicare supplemental or secondary plans. The goal is to reduce the cost of Part B drugs and drug administration, with priority given to high-investment and specialty drugs. This has resulted in a decline in the use of both hospital outpatient infusion centers and free-standing infusion centers, specifically for chemotherapy and infusions that are deemed simple. As a result, centers that had predicted a sustained growth pattern as seen in previous years are seeing flat or slow growth in infusions. Others are reporting limits on what they call “buy and bill” drugs or drugs that fall into the medical pharmacy management category. Contributing to this decline is an increase in oral drug (both in types and number of patients).

The targets for this shift in site-of-service choice are high-investment medications across five classes: autoimmune, enzyme replacement, amyotrophic lateral sclerosis, immunodeficiency and human immunodeficiency virus. And, the shift in site of service may be from a hospital-based outpatient infusion clinic to a free-standing infusion clinic, or to homecare for products such as intravenous IG and other immunotherapy products.

The goal of the site-of-care normalization program is to reduce unsustainable drug costs and lower patients’ copays. Healthcare organizations need to ensure their pricing structures don’t result in losing patients to another site of care. They must be proactively involved with payer relations and participate in payer contract amendments to avoid medication-related denials. And, they must identify the impact of site-of-care trends, understanding that any cost decreases also result in decreases in the organization’s reimbursement and patients’ copays.