CMS 2020 Proposed and Final OPPS and ASC Rules

- By Bonnie Kirschenbaum, MS, FASHP, FCSHP

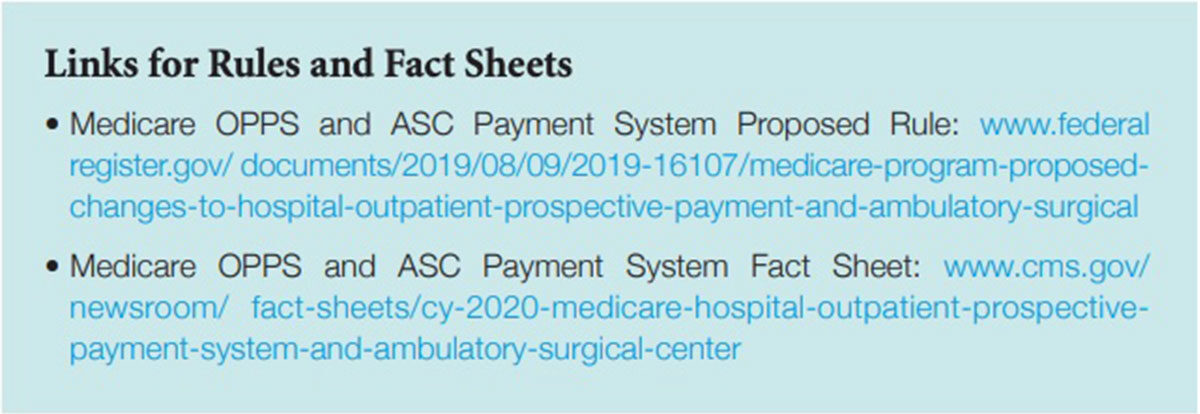

THE CENTERS FOR Medicare and Medicaid’s (CMS) proposed and final outpatient prospective payment system (OPPS) and ambulatory surgery center (ASC) rules take effect Jan. 1 (see Links for Rules and Fact Sheets). In response to the public outcry over healthcare expenses and pricing, the rules focus on transparency to reduce cost in a patient-driven healthcare system with reimbursement across the patient episodic care journey rather than on single encounters in healthcare facilities. Themes in the proposed rules are to continue to simplify electronic health records requirements, reporting and regulations; cut costs and save money by reducing operating costs and patient costs (the latter of which would go directly back to patients); and not losing focus on the opioid crisis.

Increasing Price Transparency of Hospital Standard Charges

An executive order titled “Improving Price and Quality Transparency in American Healthcare to Put Patients First” is designed to increase availability of meaningful price and quality information for patients. Its intent is transparency in healthcare pricing that is “critical to enabling patients to become active consumers so they can lead the drive toward value.” The proposal builds upon the 2015 rule that required hospitals to make public their standard charges upon request and subsequently online in a machine-readable format beginning in 2019. The new requirements are broad, requiring each hospital operating within the U.S. to establish, update and make public a yearly list of the hospital’s standard charges for items and services provided, including for diagnostic-related groups. Included are 1) definitions of “hospital,” “standard charges” and “items and services”; 2) requirements for making public a machine-readable file online that includes all standard charges for hospital items and services; 3) requirements for making public payer-specific negotiated charges for a limited set of “shoppable” services that are displayed and packaged in a consumer-friendly manner; and 4) monitoring for and addressing hospital noncompliance, including issuing a warning notice, requesting a corrective action plan, imposing civil monetary penalties and a process for hospitals to appeal penalties.

OPPS Part B Drug Payment

CMS will continue to pay for Part B drugs in five ways divided into two categories: 1) separately payable with line-item reimbursement and 2) not separately payable without line-item reimbursement since payment is part of a bundle/package. Regardless of where the drug falls in these two categories, billing for every drug is a CMS requirement. Separately payable line-item reimbursement drugs include: 1) New drugs not yet assigned a unique healthcare common procedure coding system code 2) New pass-through drugs, biologicals and radiopharmaceuticals 3) Specified covered outpatient drugs Not separately payable with no line-item reimbursement (paid as part of a bundle/package) drugs include: 4) Lower-cost packaged products costing (proposed) less than $130 per day (up from $125 in 2019)

5) Regardless of cost, products used in policy packaged services. Payment for all packaged drugs, biologicals and radiopharmaceuticals is included in the services and procedures for which they are reported. These include:

- Diagnostic radiopharmaceuticals;

- Contrast agents;

- Anesthesia drugs;

- Implantable biologicals surgically inserted or implanted in the body through a surgical incision or natural orifice;

- Drugs, biologicals and radiopharmaceuticals used as supplies in a diagnostic test or procedure; and

- Drugs and biologicals used as supplies or implantable devices in a surgical procedure.

Some non-pass-through separately payable drugs paid for at average sales price (ASP) plus 6 percent minus 2 percent sequestration will expire in the quarter as close to three full years as possible after they were first covered for pass-through payment. The proposed rule lists 65 drugs with new/continuing pass-through status and six losing pass-through status that move from status indicator (SI) G (pass through) to SI K (separately payable) or SI N (items and services packaged into ambulatory payment classification rates). For 2020, new drugs and biologicals are paid at wholesale acquisition cost (WAC) plus 3 percent until ASP is available or 95 percent of average wholesale price (AWP) if WAC is unavailable.

Thresholds for separately payable drugs and biologicals increased to $130 per day based on ASP. These will continue to be paid at ASP plus 6 percent minus 2 percent sequestration under the 2013 statutory default payment policy. CMS will pay all non-pass-through separately payable therapeutic radiopharmaceuticals at ASP plus 6 percent minus 2 percent sequestration as well.

Providers should ensure all drugs with SI G, K and N are billed regardless of whether they are separately payable (which will be published in the updated Addendum B this fall). While it is common practice for some revenue cycle teams/billing services to put a hard stop on passing SI N-posted charges to payers, this behavior creates an inaccurate claims data file because the drug therapy and its costs are missing from the encounter. It also prevents payment of injectable drug administration charges because there is no drug listed as given.

Providers should also prepare for changes in their list of waste billing drugs. They should determine which of those on their current list have moved from K to N status and will no longer be eligible for waste billing as of Jan. 1.

Payment Rate Changes for Certain Medicare Part B Drugs Purchased by Hospitals Through 340B

OPPS payment rate changes apply only to 340B-eligible Medicare patients treated in an OPPS setting. The proposed 2020 OPPS rule keeps 2018 rates that cut reimbursement for 340B facilities, as well as the modifier requirement that identifies drugs with rate cuts. Products acquired under 340B will continue to be paid at ASP minus 22.5 percent, WAC minus 22.5 percent or 69.46 percent of AWP, as applicable. OPPS reimburses in five different ways (pass-through before and after ASP is established, separately payable and bundled or packaged either due to cost or statute). Only separately payable drugs (SI K) are affected; drugs on pass-through status (SI G) and vaccines continue to be excluded. Off-campus hospital departments defined as outpatient facilities located away from the hospital’s main facility paid under physician fee service will also be subject to the reduction in 2020 and will be paid ASP minus 22.5 percent for drugs acquired through the 340B program.

CMS is continuing its policy to make all biosimilar biological products eligible for pass-through payment — not just the first biosimilar biological product for a reference product.

In a new twist and a move away from the national and local coverage determinations “honor system” concept, CMS proposes a prior authorization process for five categories of hospital outpatient department services: blepharoplasty, botulinum toxin injections, panniculectomy, rhinoplasty and vein ablation.

2020 proposals continue unpackaging and paying separately for the cost of nonopioid pain management drugs functioning as surgical supplies only in the ASC setting and not in the OPPS setting.

Hospital clinic visits will be reimbursed for site-neutral payments at the same rate as physician offices and other ambulatory facilities completing the process as in past years.

Sequestration remains in effect, and 2 percent will be deducted from every CMS payment to healthcare facilities. This applies only to the 80 percent CMS payment and not the 20 percent copay. Sequestration is the budget limit Congress created in the 2011 Budget Control Act when Republicans and Democrats couldn’t agree on the best way to lower the deficit. While they did agree to use the threat of sequester to force themselves to reach an agreement, the threat didn’t work, implementing the sequester to cut spending from 2013 through 2021. (Note: This may be extended by an additional two years to 2023.) This applies to each year’s budget, cutting an equal amount from both mandatory discretionary budgets. Mandatory programs established by acts of Congress include Medicare, Social Security and the Affordable Care Act. Sequestration also sets caps on spending.

As healthcare facilities search for every opportunity to stabilize revenue and cut costs, they must understand drug payment rules and what to do to ensure payment. Additionally, moving forward with practice changes such as working with specialty pharmacies with white bagging and negotiating with private insurers is essential.