Feeding China’s Growing Appetite for Human Albumin

- By Keith Berman, MPH, MBA

MORE THAN 40 years since embracing free market reforms, trade and investment, China has transformed itself from one of the world’s poorest countries to an industrial behemoth that has lifted as many as 800 million residents out of poverty.1 Well over 300 million people have migrated from rural villages to fast-growing cities offering manufacturing jobs.2 Projected 8 percent growth in retail spending this year by a burgeoning middle class is expected to propel China past the United States to become the world’s largest consumer goods market.3 Chinese demand for everything from cars to cell phones to imported foods is now a critical component of the global economy.

But this new consumer spending power is just one aspect of how China’s economic ascendency has raised living standards for its people. For most in a country whose per capita gross domestic product (GDP) as recently as 2007 was just $2,700 (compared to $46,400 in the U.S.), comprehensive medical care had historically been out of reach.4,5 But by 2017 — just 10 years later — healthcare expenditures as a percentage of China’s GDP increased by 50 percent,6 and per capita healthcare spending jumped nearly five-fold.

To appreciate how the “Chinese economic miracle” has helped improve access in particular to advanced medical care, one need look no further than its utilization of a single product that is widely used in hospitals to treat severely ill intensive care unit and other patients. That product, now China’s highest dollar-value prescribed therapeutic, is human albumin.

Blood, Albumin and Healthcare Access

As is done here in the U.S., Chinese physicians order albumin for acute blood volume loss situations and for hypotension or hypotensive shock, most commonly in the context of underlying severe liver or kidney disease. Advanced liver disease is a leading indication for albumin in China, which not coincidentally has the world’s highest chronic hepatitis B virus (HBV) infection burden.

Of an estimated 240 million people globally living with chronic HBV, some 90 million live in China, of whom an estimated 28 million require treatment and seven million require urgent, intensive treatment for advanced liver disease. Ten million others live with chronic hepatitis C virus (HCV) infection, 2.5 million of whom with cirrhosis or liver cancer also require urgent treatment that sometimes includes administration of albumin.7 Atop this is a growing prevalence of cirrhosis and end-stage liver disease traceable to dramatic increases in alcoholic and nonalcoholic fatty liver disease (NAFLD), which in turn are related to recent lifestyle changes throughout the industrialized world.8

In China, it is also not unusual for albumin to be given to other very ill and commonly hypoproteinemic patients with cancers, lower respiratory disorders, including COPD and other severely debilitating diseases. This practice originates with the principle in traditional Chinese medicine (TCM) that blood is closely identified with the individual’s “qi,” which translates as “life force” or “vital energy.”9 In TCM, qi and blood are two of the vital substances that are crucial to health. Blood is the liquid life force that nourishes and restores the body and organs that, in turn, produce more qi. Conversely, according to TCM, the loss of blood weakens the individual; thus, many Chinese, including older adults in particular, are unwilling to donate blood.

While the influence of TCM on Chinese medical practice has diminished over the past several decades, this association between blood and qi still appears to account for some albumin prescribing for cancer and other patients experiencing weakness, malaise or exhaustion.

But in a country where, as recently as 2010, annual spending on healthcare per resident was just $200, most Chinese still had limited access to advanced hospital care where albumin treatment is provided. That picture has changed dramatically over the ensuing eight years as healthcare spending — and demand for albumin in particular — has outpaced even the torrid pace of economic growth that doubled China’s GDP to more than $13 trillion.

China’s Albumin Demand Far Outpaces Plasma Supply

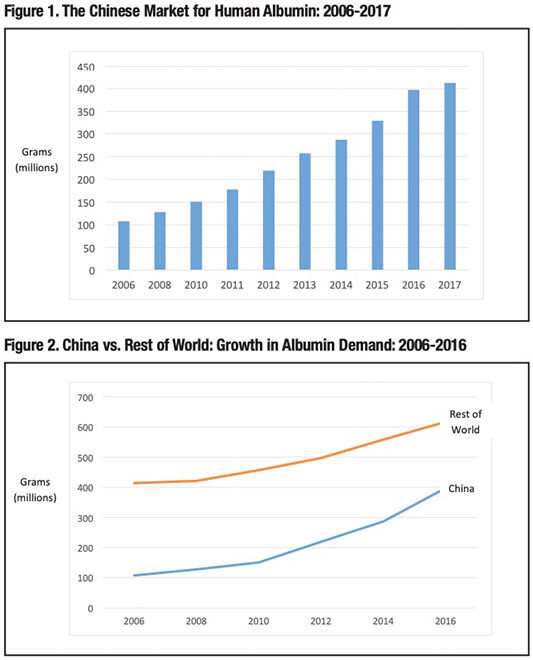

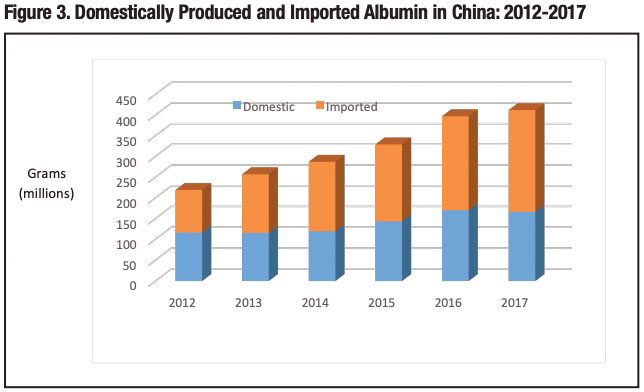

From a 108 million-gram market in 2006, utilization of albumin in China grew nearly four-fold to 412 million grams by 2017, or nearly 300 grams per 1,000 residents (Figure 1).10,11 As a result of this extraordinary demand growth, which approximately equaled that of all other countries combined (Figure 2), China today accounts for fully one-third of the global albumin market.

A series of purification or “fractionation” steps yields about 25 grams of albumin from each liter of collected donor plasma. More than 90 percent of the global supply of plasma for fractionation comes from “source plasma,” which is typically collected from remunerated donors in dedicated licensed centers that use automated apheresis equipment to perform plasmapheresis to separate and retain only the plasma portion of donor blood. The balance of the plasma supply comes from “recovered plasma” separated from whole blood donations that is not needed for direct transfusion into hospital patients. In 2017, approximately two-thirds of the fractionation industry’s global plasma supply needs were met by 35 million liters of source plasma collected at more than 700 U.S. plasma donor centers, together with about two million liters of recovered plasma from U.S. whole blood donations. China’s current legislation permits only source plasma to be used for domestic fractionation into albumin and other plasma-based therapeutics. To meet the country’s current albumin needs would require collection of well over 16 million liters of source plasma. With a population four times that of the U.S., one might reasonably expect thatChina is — or soon could become — self-sufficient in meeting its own plasma requirements.

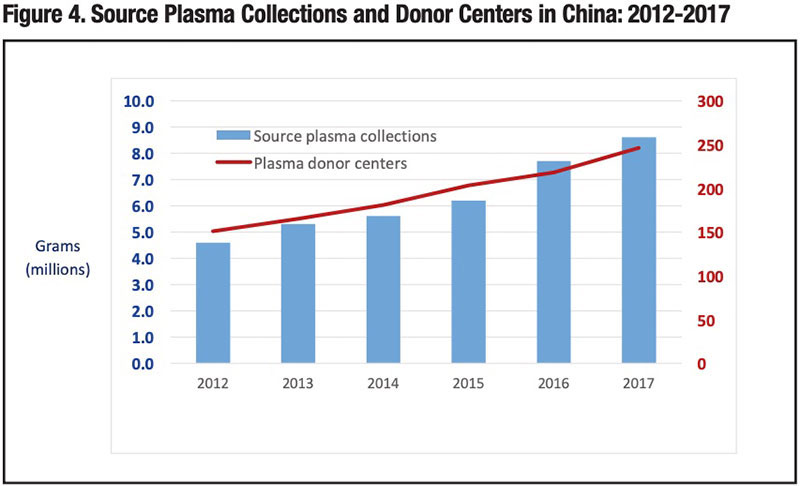

But, in fact, China remains heavily reliant on imported albumin manufactured mainly from U.S. source plasma. In 2017, domestically sourced plasma from about 250 collection centers accounted for just 40 percent of the country’s 412 million-gram albumin requirement (Figure 3).11 The other 60 percent was met by importing albumin products manufactured by the world’s four leading commercial suppliers: CSL Behring, Grifols, Takeda (formerly Shire/Baxalta) and Octapharma.

Several factors combine to constrain China’s ability to expand domestic plasma collection activity:

- As a result of a government policy mandating a large geographic separation from blood donor centers, plasmapheresis facilities generally must be situated in outlying rural areas, making the donation experience more time-consuming and inconvenient. And, more than one billion people, including many in China’s most populous cities, live entirely outside the designated regions where source plasma can be collected.11

- Chinese plasmapheresis donors can contribute no more frequently than once every two weeks — four times less frequently than the U.S. twice-weekly donation limit.

- Otherwise available unused plasma from whole blood donations is not permitted for manufacture into albumin and other plasma products; however, this policy is being reconsidered by Chinese health authorities.12

- A still widely-held belief that loss of blood weakens one’s qi dissuades many Chinese from considering donating blood or blood plasma. Despite all these limitations, new plasma collection centers continue to be opened in some Chinese provinces, and total domestic plasma collections have increased an average of about 15 percent annually over the last three years for which data are available (Figure 4).11

Excess Production Capacity Equals Market Stability

It now appears that the remarkable run-up in demand that established China as by far the world’s largest albumin market may be winding down. After a decade of double-digit growth, China’s albumin consumption grew just 4 percent in 2017. Preliminary data indicate a similarly low growth rate in 2018. This slowdown in albumin demand growth coincides with several government-mandated distribution and other healthcare policy reforms introduced in early 2017.

But, even if we assume that China’s current 15 percent plasma collections growth pace is sustainable and domestic albumin demand growth will indefinitely remain in the low single digits, the country will likely not become plasma self-sufficient until midway through the next decade.

Fortunately, China’s ongoing reliance on imported albumin products does not in any way impact the availability of albumin for the U.S. or other countries; commercial fractionators can readily continue to fill China’s albumin supply gap. The reason lies in the fact that global requirements for the plasma raw material are not dictated by albumin demand, but instead by the global demand for intravenous immune globulin (IVIG) and subcutaneous immune globulin (SCIG) products.

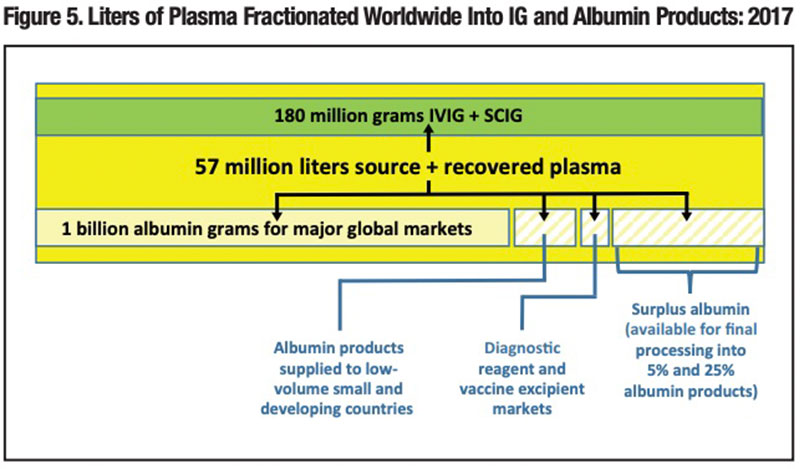

In 2017, an estimated 57 million liters of donor plasma were processed to produce more than 180 million grams of polyvalent IG products to supply the global market demand (Figure 5).13 Not surprisingly, IG product supplies here in the U.S. and internationally were — and continue to be — tight, as plasma raw material supply and IG products manufactured from it just manage to keep pace with worldwide demand growth.

To meet albumin demand in the U.S. and about 70 other countries with well-documented albumin consumption data, just over one billion grams were purified from that same plasma in 2017. But since each liter of plasma yields an average of 25 grams of albumin, only about 40 million (one billion grams divided by 25 grams/liter) of the 57 million processed liters of plasma were needed to meet that one billion-gram albumin requirement.

What happens to the roughly 425 million grams of albumin purified from those 17 million additional liters of plasma that were processed to keep up with global IG demand? Some is supplied as finished product to small and developing countries mainly on the Asian and African continents, for which reliable albumin and other plasma protein utilization data are not available. An estimated 5 percent is sold to manufacturers of diagnostics and vaccines for use as a reagent or product excipient. But most of the rest is simply surplus albumin with no immediate end-user market. Some of that surplus albumin may be stored in a bulk form called Fraction V, which is not final-purified or bottled.

So, because the global plasma requirement dictated by global IG demand substantially exceeds the plasma requirement to meet global albumin, there is in essence a global “safety stock” of plasma albumin protein that can absorb a surge in albumin demand. That is why, in the midst of China’s “economic miracle” that boosted its albumin imports by nearly 200 million grams between 2007 and 2017, here in the U.S., albumin remained in good supply, and its price remained stable.

Could rising economic fortunes in other developing countries in Asia or elsewhere generate a major new surge in demand for albumin? In the event we see a near-term spike in demand for albumin imports, it is reassuring to know the industry is fully prepared to address it — without missing a single delivery to any albumin customer anywhere in the world.

References

- Morrison WM. China’s Economic Rise: History, Trends, Challenges, and Implications for the United States. Congressional Research Service, Feb. 5, 2018.

- Mauldin J. China is building the world’s largest innovation economy. Forbes, September 19, 2018. Accessed 4/8/2019 at www.forbes.com/sites/johnmauldin/2018/09/19/china-is-building-the-worlds-largest-innovation-economy/#386218606fd4.

- SunN. China to surpass U.S.as world’s biggest consumer market this year. Nikkei Asian Review, 24 Jan 2019. Accessed 4/8/2019 at asia.nikkei.com/Economy/China-to-surpass-US-as-world-s-biggest-consumer-market-this-year.

- World Bank. GDP per capita. Accessed 4/12/2019 at data.worldbank.org/indicator/NY.GDP.PCAP.CD?locations=CN.

- World Bank. GDP per capita. Accessed 4/12/2019 at data.worldbank.org/indicator/NY.GDP.PCAP.CD?locations=US.

- Statista. Health expenditure in China as a proportion of GDP from 2007 to 2017. Accessed 4/19/2019 at www.statista.com/statistics/279402/health-expenditure-in-china-as-a-proportion-of-gdp.

- World Health Organization. Up to 10 million people in China could die from chronic hepatitis by 2030. Accessed 4/14/2019 at www.wpro.who.int/china/mediacentre/releases/2016/20160727-china-world-hepatitis-day/en.

- Wang F, Fan J, Zhang Z, et al. The global burden of liver disease: The major impact of China. Hepatology, 2014 Dec;60(6):1099-2108.

- China.org. Blood: The mother of Qi and why donating isa big deal in China. Accessed 4/18/2019 at www.china.org.cn/english/health/235233.htm.

- The Marketing Research Bureau, Inc. Albumin Usage and Demand Forecast in China: 2013-2020. November 2014.

- Xiangjun D. China Plasmapheresis: Challenges and Suggestions. International Plasma Proteins Congress(IPPC), Budapest, Hungary, March 14, 2018.

- Liu Y, Li C , Wang Y, et al. Which is safer source plasma for manufacturing in China: apheresis plasma or recovered plasma? Transfusion, 2016 May;56:1153-60.

- Data on file. The Marketing Research Bureau, Inc.